The current booming oil and gas revenues flowing to the state are almost enough to make New Mexicans forget the massive budget cuts we experienced just a few short years ago. As a legislator who had to make tough decisions then, I recognize that long-term diversification of state revenues remains a critical priority for our kids’ and grandkids’ futures. That’s why Senator Shendo and I have introduced Senate Bill 155 which would create the Economic Diversification and Climate Resilience fund using fifty percent of the oil and gas production tax revenue that would otherwise flow into the general fund.

These taxes include the oil and gas emergency school tax and the oil and gas conservation tax. Our bill would essentially treat half of those production tax collections as nonrecurring dollars, diverting those revenues into a separate fund that would be appropriated by the Legislature for important investments in diversifying the economy. By diverting half of the production tax revenue, our bill would immediately reduce general fund recurring budgetary reliance on oil and gas revenues.

Additionally, this would set up a funding stream for nonrecurring appropriations dedicated to diversifying the state economy and growing key industries within the state, as well as making investments in workforce training and development, infrastructure improvements to attract business development and improve supply chains, and projects that support the conservation and restoration of public lands, forests, watersheds, parks and trails.

The mining and oil and gas industries make up about 14 percent of New Mexico’s gross state product, but revenues related to these industries make up over 30 percent of our general fund state budget. Although the oil and gas industry is important to New Mexico’s economy, revenues from this industry make up a disproportionate amount of our general fund budget. This disproportionate budgetary reliance indicates that diversifying our economy alone will not be enough to end the boom-and-bust cycles in the general fund.

A recent LFC report showed us exactly how to do this: For FY23, LFC staff estimated general fund revenues dependent on the oil and gas industry will be 31 percent, down from the 38 percent it would otherwise be if those excess oil and gas dollars were not swept into other funds, reducing our reliance on the general fund.

Some may claim we are hurting general fund projects by diverting funds; however, even after distributing the excess above the five-year average, the consensus estimate projects production tax revenue to the general fund will be $795 million in FY23, up from the $474 million received in FY18, which is the year before the Legislature began the practice of diverting the excess revenue to reserve funds. If we continue to grow recurring budgets using this historic growth in oil and gas revenue, the general fund reliance on oil and gas will only continue to increase, and important state services provided through recurring agency budgets will continue to be subjected to the boom-and-bust cycles of the industry.

We have an historic opportunity this session to transform the way we think about and appropriate oil and gas revenues. With significant changes to global energy demand expected to occur in the coming decades, we need to act now to reduce our state budget dependence on oil and gas revenue. We need to use those funds to make significant, thoughtful, and targeted investments in diversifying our state economy and protecting our public lands. Our kids and grandkids deserve nothing less.

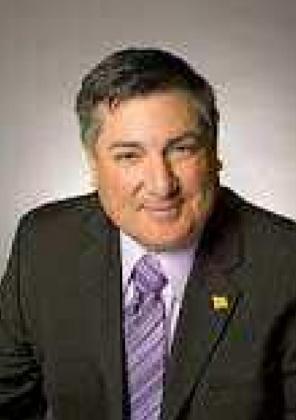

Senator George K. Munoz

Chairman, Senate Finance Committee